Secure a Brighter Future:

College Admissions Help with a Dedicated College Advisor

Our team of college planning experts will help your family through the academic and college admissions process, setting your child up for lifelong success.

Your College Planning Experts

We know how stressful college admissions can be, and we know what’s at stake. That’s why we get to know each family and work to unlock every student’s standout factor. We are here with you for the entire process — from applications to letters of acceptance.

- Featured workshop

20 Tips For College Admissions Success: Apply, Afford, Succeed

- Choosing The Right Major

- Building a College List and Selecting Schools

- Common App and Essay Writing Basics

You Know You Need

College Admissions Help,

But Where to Start?

Do you want your student to get into the best college for them, setting them up to be successful in life? To know whether HelloCollege is for you, ask yourself:

Do you want your child to reach their full potential at the best possible school?

Do you find the application process overwhelming process and not know where to start?

Are you unsure how you’ll afford the best schools?

Do you feel like your child would listen to a third-party expert more than mom and dad?

Do you worry you don’t fully understand how the admissions process has changed in recent years?

Do you not have time to figure it all out and just want expert college admissions help to cut to the chase?

Are you unsure how to identify the schools that best fit your child's needs and goals?

Are you worried you’ll miss a deadline or important detail?

The college planning experts at HelloCollege will simplify the admissions process, answering all of your questions and setting your student on a path to success.

College Planning Experts with a Roadmap to Success

Get a dedicated college advisor to guide your student from day one. We simplify applications, essays, scholarships, and loans, while our 24/7 online portal keeps you and your student on track. Start early, finish strong, and secure the best opportunities for your child's future.

Identify a Standout Factor

Build a College List

Formalize a Custom Application Plan

Craft Essays and Applications

Secure a Better Future

With our proven track record, we replace the daunting uncertainties of college admissions planning with a clear roadmap to acceptance at your dream school. Stop guessing: your child's future is too important to leave to chance.

A+ Guidance & Mentoring

Our team of college advisors have been there, done that, and they know how to guide your child toward success. Your aspirations are our goals, and we've got the blueprint to achieve them. Put the college planning experts in your corner with HelloCollege.

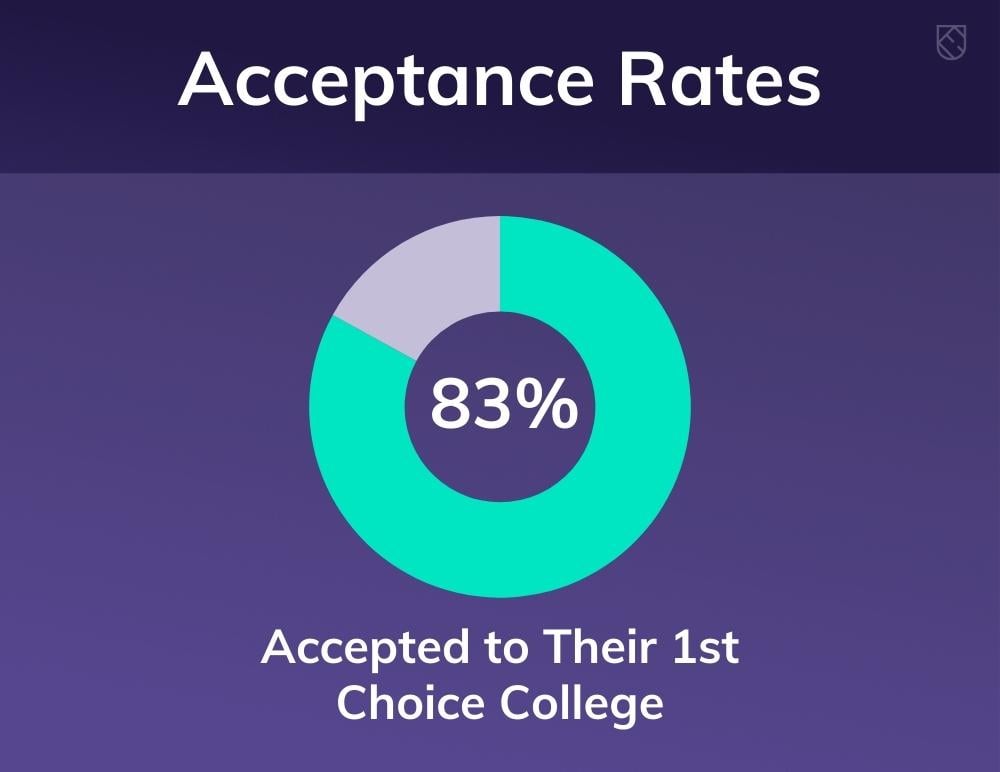

Our Results Speak for Themselves.

See the results families like yours have achieved through our college admissions program.

Increased Acceptance Odds

In today's admissions landscape, it's not enough to have great grades and test scores. Students need to stand out. That's why we help students identify their strengths and passions to create a Standout Factor, to help admissions understand each student's unique strengths. Our expert college advisors then provide a framework to keep organized while completing myriad application tasks and to reduce stress along the way.

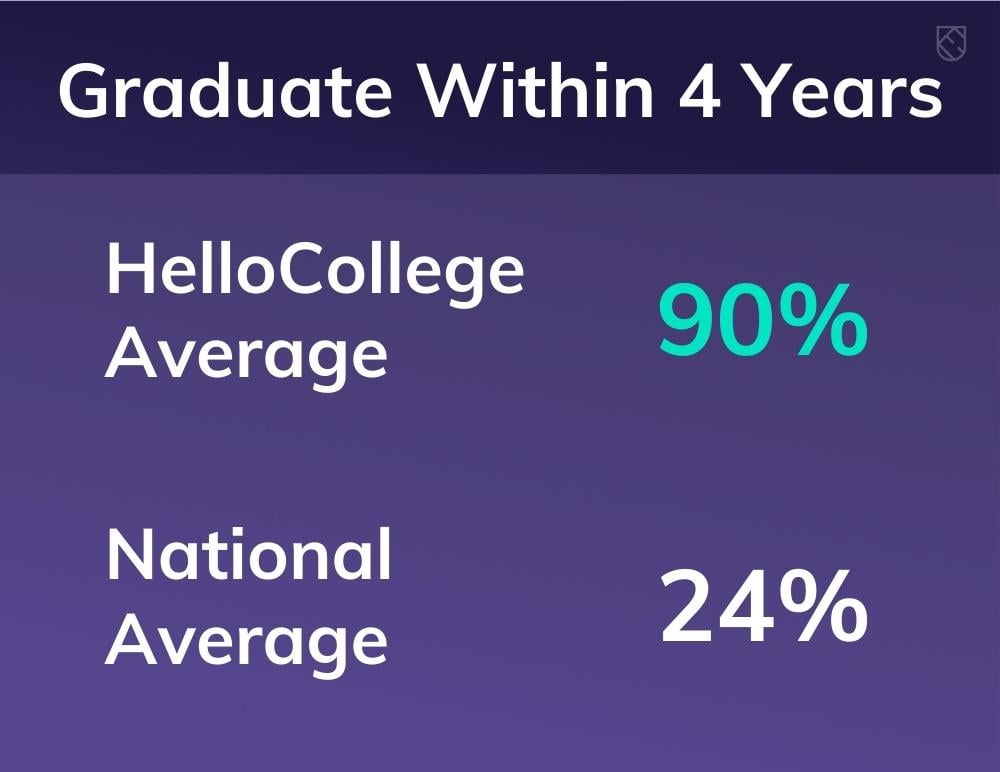

On-Time Graduation

Did you know that the average 4-year degree actually takes 5.7 years to complete? It doesn't help that 37% of students transfer colleges and 80% change majors. We help students zero in on the right college list and major using our proprietary S.A.F.E. methodology. This leads to happy students with a career path after college — and it avoids the tens of thousands of dollars in college costs caused by delays in graduation.

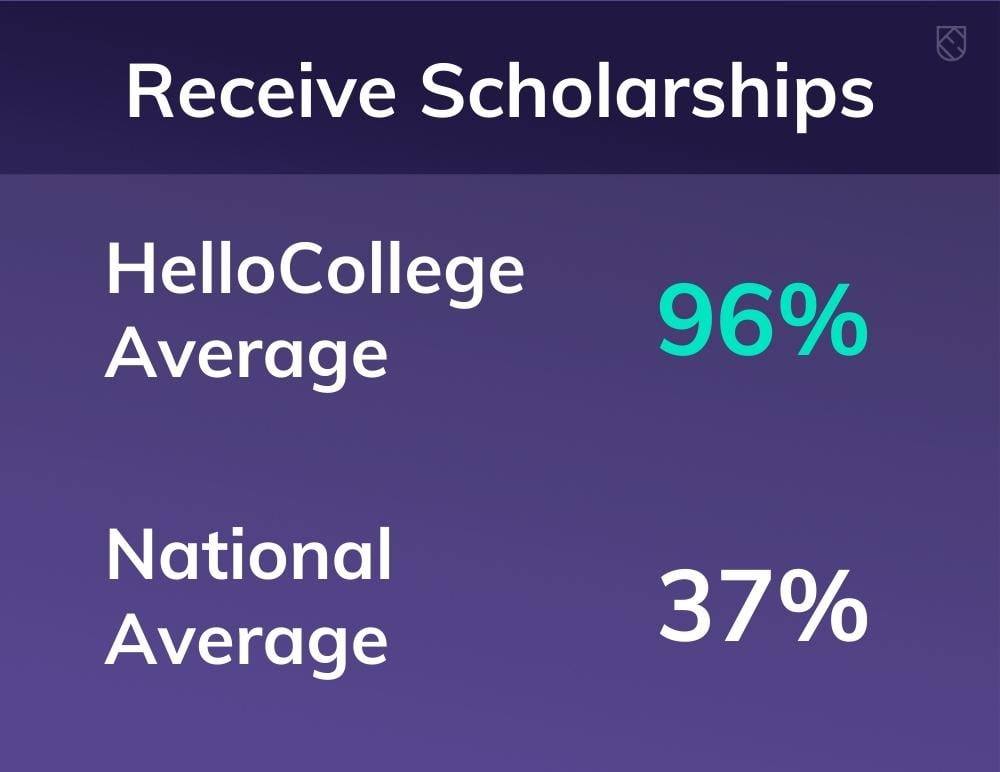

Reduced Debt & Maximized Scholarships

We help families target the best schools for their financial situation by illuminating the real costs of college and helping to evaluate options. We work with students to create a target list of merit- and need-based scholarships that reflect each student's profile and interests, and we assist with the essays needed to apply. We then help families analyze their offers from each college and craft appeals.

Eliminate College Anxiety

Forget the sleepless nights worrying about college deadlines and requirements. We shoulder that burden so you can focus on what really matters — your family.

With HelloCollege, you'll stay on track and submit your applications with confidence.

A High School

Guidance Counselor Alone

Is Not Enough.

The average high school student, throughout all 4 years of high school, spends only 38 minutes with their counselor. As a HelloCollege students, by contrast, you'll have a team of college planning experts in your corner, meeting regularly to answer your every question.

While doing the best they can, school counselors are often stretched too thin, managing hundreds of students and their varied needs. They simply can't provide the personalized attention or in-depth knowledge required for this critical process.

HelloCollege assigns a dedicated college advisor to focus solely on your child's journey to college. Backed by financial specialists, essay coaches, tutors, and an online portal, we offer an unmatched level of attention and customization.

Check Out Our School Roster

We’ve helped thousands of students get accepted at the best colleges.

What Your College Admissions Journey Could Be Like

On Your Own

- Getting lost in forms, deadlines, and essays wondering if you've missed a step

- Weighed down by the stress of admissions on top of a busy life

- Feeling overwhelmed with a strained relationship with your child

With HelloCollege

- A counselor and team of experts lifting the burden off of your shoulders

- Take the guesswork out of applications and scholarships

- Peace of mind knowing you've done everything to ensure your child's succes

Invest In Success

You plan for your child's future. You invest in your home to keep them safe and in sports and extracurriculars to keep them healthy and involved. Why wouldn't you invest in their academic and professional future?

Your investment in college planning will pay exponential returns in academic success and scholarship opportunities. A small commitment now can mean a world of opportunities for your child's future.

Use Our S.A.F.E. College Selection Framework

This proven process has helped thousands of families find college success.

Evaluate your needs.

Get personalized guidance.

Get accepted!

- Featured resource

College Admissions Timeline

- Key deadlines in the admissions process

- What you need to do in all 4 years of high school

- Increase admissions odds